See if you Qualify for IRS Fresh Start Request Online. No Fee Unless We Can Help.

Irs Help By City Tax Debt Advisors

Ad Owe back tax 10K-200K.

. Owe IRS 10K-110K Back Taxes Check Eligibility. Contact our Tax Relief experts today. Complete Your Free Tax Extension in 5 Minutes.

Extend Your Tax Return Due Date by 6 Months. Solve Your IRS Debt Problems. What is an IRS Levy.

If you receive any type of income from the federal government and you owe money to the irs there is. When taxpayers do not pay delinquent taxes the Internal Revenue Service IRS can work directly with financial institutions and other third parties to seize the taxpayers. The Federal Payment Levy Program FPLP is an automated system the IRS uses to match its records against those of the governments Bureau of the Fiscal Service BFS to identify.

Ad As Seen On TV Radio. It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real. The federal payment levy program fplp is a us.

After Fiscal Service matches federal. An IRS levy permits the legal seizure of your property to satisfy a tax debt. Ad As Seen On TV Radio.

Trusted Reliable Experts. In the case of the tax levy program IRS supplies Fiscal Service with an electronic file containing tax debt information for inclusion in the TOP database. Ad Remove IRS State Tax Levies.

The Automated Levy Program allows the IRS to coordinate with other federal state and municipal. The New York State False Claims Act allows an individual to file a New York State False Claims Act. Ad Take 1 Min Find Out Free If Qualify For Tax Relief.

A federal tax levy is when the IRS seizes your property to pay taxes you owe without the need to take you to court. Irs tax levy program. Ad Extend Your 2021 Tax Return Filing Date.

Solve Your IRS Debt Problems. We work closely with the IRS state Tax Relief experts. The IRS can also use the Federal Payment Levy Program FPLP to levy continuously on certain federal payments you receive such as Social Security benefits.

In addition responsible officers. Review Comes With No Obligation. Appeal the Levy The IRS does not just spring a tax levy on you.

Get Your Free Tax Review. Within that period you can make a formal. The IRS Whistleblower Program is not the only program to blow the whistle on Tax Fraud.

Tax levies can also include such actions as the garnishment of your wages. The IRS began sending out letters from the Automated Collection System function in June and restarted the income tax levy program in July. There are thirty days between the notification of intent and the tax levy.

Ad We can help you negotiate with the IRS. The IRS will begin sending out certain levy notices as early as July 15 2021. Complete Your Free Tax Extension in Only Minutes.

Irs Help By City Tax Debt Advisors

Irs Cp504 Notice Of Intent To Levy What You Should Do

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Overview Of The Treasury Department S Federal Payment Levy And Treasury Offset Programs Everycrsreport Com

Irs Tax Levy Tax Law Offices Of David W Klasing

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Cp 508c Notice Of Certification Of Your Seriously Delinquent Federal Tax Debt To The State Department

Irs Tax Letters Explained Landmark Tax Group

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Tax Lien Help Greensboro Ga 30642 M M Financial Blog Irs Taxes Tax Debt Tax Debt Relief

How To Avoid The Dreaded Federal Payment Levy Program

Tax Levy Understanding The Tax Levy A 15 Minute Guide

5 19 9 Automated Levy Programs Internal Revenue Service

5 19 9 Automated Levy Programs Internal Revenue Service

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

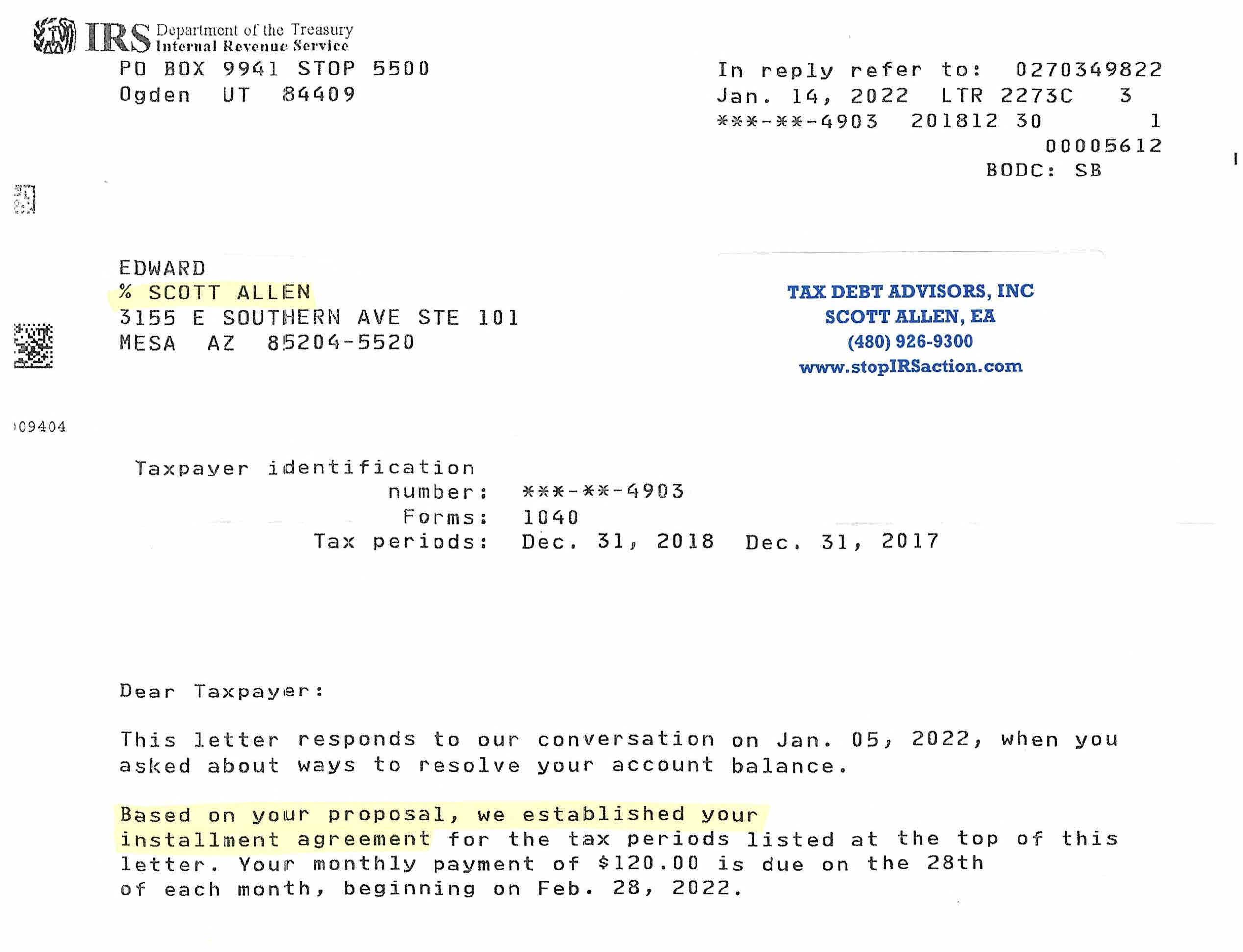

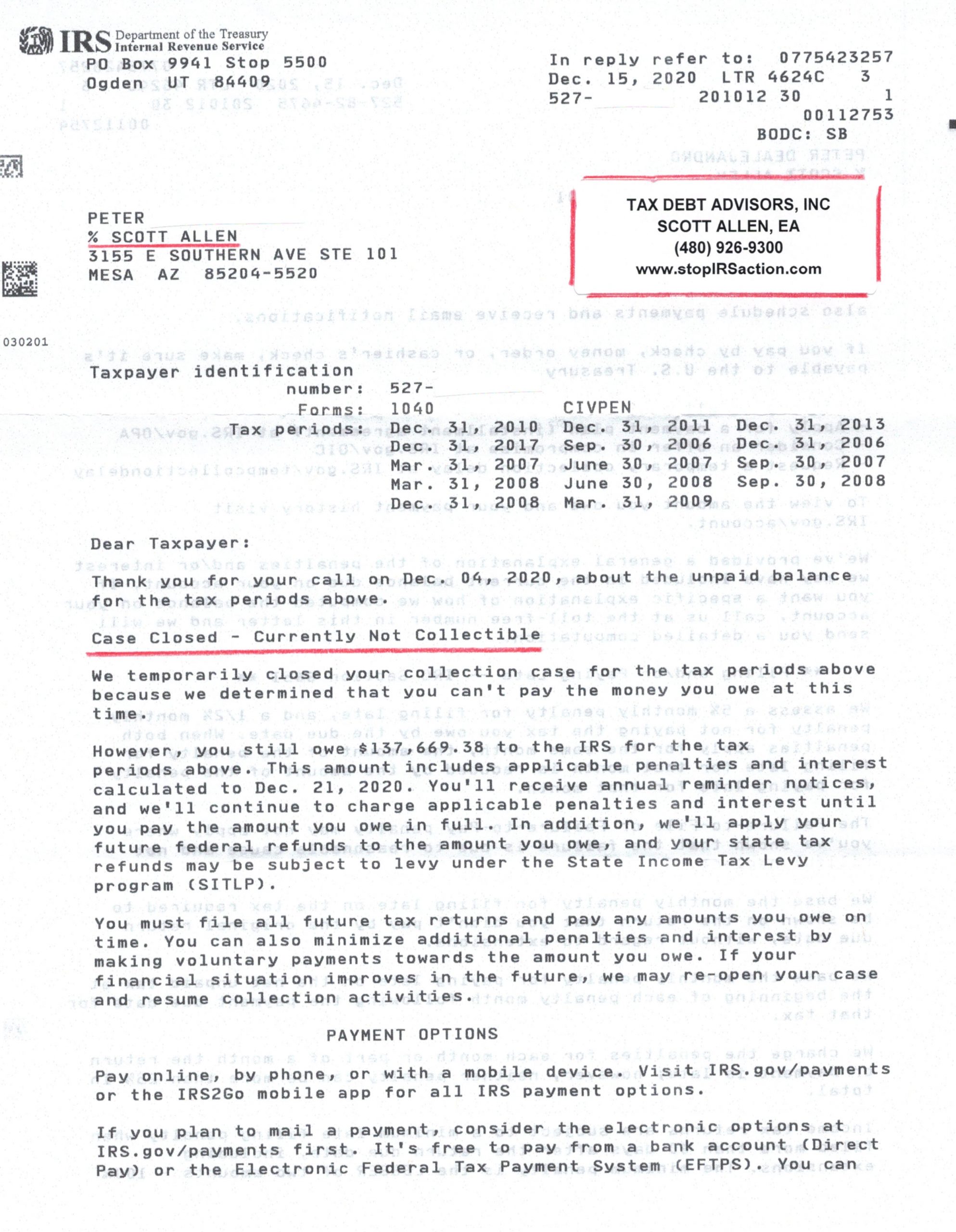

Irs Audit Letter Cp504 Sample 1

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services